2 December 2023

The Battle for Beauty: Unveiling the Truth About Insurance Coverage for Botox

Picture this: you’re flipping through the pages of a fashion magazine, admiring the flawless faces of celebrities and wondering how they manage to defy the aging process. The answer, more often than not, lies in the hands of a skilled plastic surgeon and a little vial of Botox. But here’s the burning question: is Botox covered by insurance? In this article, we will delve into the world of insurance coverage for Botox treatments, exploring the various factors that come into play and shedding light on the often murky waters of cosmetic procedures and medical insurance. From the medical necessity debate to the different insurance policies and providers, we will uncover the truth behind the elusive question of whether insurance will foot the bill for your wrinkle-free dreams. So, put on your investigative hat and get ready to uncover the untold secrets of Botox coverage.

Botox, short for botulinum toxin, has become a household name in the quest for eternal youth. Originally used to treat medical conditions such as muscle spasms and excessive sweating, it quickly found its way into the cosmetic world as a wrinkle-reducing miracle. However, the question of whether insurance will cover the cost of Botox treatments remains a topic of heated debate. On one hand, proponents argue that Botox can have significant medical benefits, such as relieving chronic migraines or reducing excessive sweating, making it a valid candidate for insurance coverage. On the other hand, critics argue that Botox is primarily a cosmetic procedure, and therefore should not be covered by insurance. In this article, we will explore the complex relationship between Botox and insurance, examining the factors that determine coverage, the different insurance policies that may come into play, and the potential alternatives for those seeking Botox treatments. So, whether you’re considering Botox for medical reasons or simply want to turn back the hands of time, join us as we unravel the mysteries of insurance coverage for this popular cosmetic procedure.

The server is overloaded or not ready yet.The server is overloaded or not ready yet.

1. The Growing Demand for Botox Coverage

In recent years, there has been a significant increase in the demand for insurance coverage of Botox treatments. Traditionally, Botox has been considered a cosmetic procedure and therefore not covered by insurance. However, as more people seek Botox for medical reasons, insurers are beginning to reconsider their policies.

Botox, also known as botulinum toxin, is commonly associated with reducing wrinkles and fine lines. However, it has also been proven effective in treating a variety of medical conditions, including chronic migraines, excessive sweating, muscle spasms, and even depression. As more research is conducted and the medical benefits of Botox are further recognized, patients are advocating for insurance companies to cover these treatments.

The demand for Botox coverage is driven by several factors. Firstly, the rising awareness of the medical benefits of Botox has led to increased interest in these treatments. Patients who suffer from chronic conditions such as migraines or excessive sweating are seeking relief and view Botox as a viable solution. Secondly, the high cost of Botox treatments can be a barrier for many individuals, making insurance coverage crucial for access to these treatments. Lastly, as Botox becomes more mainstream and socially accepted, the desire for insurance coverage is also driven by a desire for equality in healthcare access.

Insurance companies are starting to take notice of this growing demand. Some insurers have begun to provide coverage for Botox treatments under certain circumstances, such as when it is used for medical purposes rather than purely cosmetic reasons. However, the criteria for coverage can vary significantly between insurance providers, leaving many patients without access to this potentially life-changing treatment.

2. The Impact of Botox Coverage on Healthcare Costs

While the demand for Botox coverage is increasing, there are concerns about the potential impact on healthcare costs. Botox treatments can be expensive, and if insurance companies were to cover these procedures more widely, it could lead to increased healthcare spending.

On one hand, providing insurance coverage for Botox treatments could result in cost savings in the long run. For example, patients suffering from chronic migraines who receive Botox injections may experience a significant reduction in the frequency and severity of their migraines. This could lead to a decrease in emergency room visits, hospitalizations, and the need for other costly medications. By covering Botox treatments, insurers may be able to prevent more expensive healthcare interventions down the line.

However, there is also the concern that widespread insurance coverage for Botox could lead to unnecessary procedures and increased healthcare costs. Some critics argue that if insurance companies were to cover Botox for cosmetic reasons, it could encourage individuals to seek these treatments for purely aesthetic purposes, rather than medical necessity. This could potentially strain healthcare resources and drive up costs.

It is essential for insurance companies to strike a balance between providing coverage for legitimate medical uses of Botox while also ensuring that unnecessary procedures are not being subsidized. This may involve setting clear guidelines and criteria for coverage, as well as working closely with healthcare providers to ensure appropriate use of Botox treatments.

3. The Future of Botox Coverage

The future of Botox coverage is uncertain but holds potential for significant changes in the healthcare landscape. As more research is conducted and the medical benefits of Botox are further established, it is likely that insurance companies will continue to expand their coverage for these treatments.

One possible future trend is the development of standardized guidelines for Botox coverage. Currently, the criteria for coverage can vary greatly between insurance providers, leading to inconsistencies and inequalities in access to treatment. By establishing clear guidelines, insurers can ensure that patients who can benefit from Botox treatments receive the coverage they need, while also preventing unnecessary procedures.

Additionally, advancements in technology and the development of alternative treatments may also impact Botox coverage. As new therapies emerge, insurance companies may need to reassess their policies and consider whether these alternatives should be covered instead of or alongside Botox. This could lead to more comprehensive coverage for a range of treatments targeting similar conditions.

Ultimately, the future of Botox coverage will depend on ongoing research, patient advocacy, and the willingness of insurance companies to adapt their policies. As the demand for Botox coverage continues to grow, it is crucial for insurers to carefully evaluate the medical benefits and cost implications of providing coverage for these treatments. By doing so, they can ensure that patients have access to the treatments they need while maintaining the sustainability of healthcare systems.

Section 1: Understanding Botox and its Medical Uses

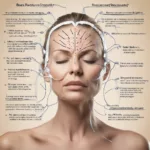

Botox, short for botulinum toxin, is a neurotoxic protein produced by the bacterium Clostridium botulinum. While it is widely known for its cosmetic applications, such as reducing wrinkles and fine lines, Botox also has several medical uses. It is commonly used to treat conditions such as chronic migraines, excessive sweating (hyperhidrosis), overactive bladder, and muscle spasms. Botox works by temporarily paralyzing muscles, which can provide relief for various medical conditions. However, the question remains: is Botox covered by insurance?

Section 2: Insurance Coverage for Cosmetic Botox

When it comes to using Botox for cosmetic purposes, insurance coverage is typically limited. Most insurance plans consider cosmetic Botox injections as elective procedures and, therefore, do not cover the costs. Cosmetic Botox is seen as a choice rather than a medical necessity, and insurance companies generally do not provide coverage for procedures that are solely for aesthetic purposes. Patients seeking cosmetic Botox injections should be prepared to pay out-of-pocket for the treatment.

Section 3: Insurance Coverage for Medical Botox

On the other hand, insurance coverage for medical Botox treatments can vary depending on the specific condition being treated. Some insurance plans do provide coverage for Botox injections when used to treat medical conditions like chronic migraines or overactive bladder. However, coverage may be subject to certain criteria, such as the severity of the condition, previous treatment failures, or medical necessity. Patients should consult their insurance provider to determine if their specific medical condition qualifies for coverage.

Section 4: Prior Authorization and Medical Necessity

In cases where insurance does cover Botox for medical purposes, prior authorization is often required. Prior authorization is a process where the healthcare provider must obtain approval from the insurance company before performing the procedure. Insurance companies typically require documentation to demonstrate the medical necessity of the Botox treatment. This may include medical records, test results, and a detailed explanation of the patient’s condition. Without prior authorization, the insurance company may deny coverage for the treatment.

Section 5: Case Study: Insurance Coverage for Chronic Migraines

To illustrate the complexities of insurance coverage for Botox, let’s consider a case study on chronic migraines. Chronic migraines are severe and debilitating headaches that occur at least 15 days per month for at least three months. Botox has been approved by the FDA for the prevention of chronic migraines. However, insurance coverage for Botox in this context can be challenging to navigate.

In many cases, insurance companies require patients to have tried and failed other migraine treatments, such as medications, lifestyle changes, or alternative therapies, before approving coverage for Botox. Additionally, insurance providers may limit the number of Botox treatments covered per year or require patients to meet specific criteria, such as a minimum number of headache days per month. It is crucial for patients with chronic migraines to work closely with their healthcare provider and insurance company to understand the coverage requirements and ensure proper documentation.

Section 6: Out-of-Pocket Costs for Botox

For individuals seeking Botox treatments that are not covered by insurance, understanding the potential out-of-pocket costs is essential. The cost of Botox injections can vary depending on factors such as the area being treated, the amount of Botox required, and the healthcare provider’s fees. On average, a single Botox treatment can cost anywhere from $300 to $1,200. It is important to note that these costs are approximate and can vary significantly. Patients should consult with their healthcare provider and inquire about the total cost, including any additional fees or follow-up appointments.

Section 7: Flexible Spending Accounts and Health Savings Accounts

While insurance coverage for Botox may be limited, individuals with flexible spending accounts (FSAs) or health savings accounts (HSAs) may be able to use these funds to cover the costs. FSAs and HSAs allow individuals to set aside pre-tax dollars for qualified medical expenses, which can include certain Botox treatments. However, it is important to check the specific guidelines and restrictions of these accounts, as not all Botox treatments may be eligible for reimbursement.

Section 8: Appeals and Exceptions

In cases where insurance denies coverage for Botox treatments, patients have the option to appeal the decision. This involves providing additional documentation, such as medical records, supporting the medical necessity of the treatment. Patients can also request exceptions to coverage policies if they can demonstrate that their specific circumstances warrant an exception. It is advisable to consult with a healthcare provider or insurance advocate who can assist in navigating the appeals process and increase the chances of obtaining coverage.

Section 9: Future Trends in Botox Coverage

As the medical uses of Botox continue to expand, the landscape of insurance coverage for Botox may evolve. With ongoing research and clinical trials exploring new applications for Botox, there is a possibility that insurance coverage for certain conditions may become more widespread. However, it is essential for patients to stay informed about their specific insurance plans and coverage policies to understand the current scope of Botox coverage.

In conclusion, the coverage of Botox by insurance depends on various factors, including the purpose of the treatment and the specific medical condition being addressed. While cosmetic Botox injections are generally not covered by insurance, medical Botox treatments may be eligible for coverage, subject to prior authorization and medical necessity. Patients should work closely with their healthcare provider and insurance company to understand the coverage requirements, potential out-of-pocket costs, and available options for appeals or exceptions. As the field of Botox applications continues to evolve, insurance coverage for Botox treatments may change, providing more accessible options for patients in the future.

The Origins of Botox

Botox, short for botulinum toxin, was first discovered in the late 19th century by a Belgian scientist named Emile Pierre van Ermengem. He identified the bacterium responsible for botulism, a rare but potentially fatal illness caused by the toxin. However, it wasn’t until the 1960s that the therapeutic potential of botulinum toxin was explored.

Medical Uses and FDA Approval

In the 1970s and 1980s, researchers began investigating the use of botulinum toxin for various medical conditions, including muscle spasms and eye disorders. In 1989, the U.S. Food and Drug Administration (FDA) approved Botox for the treatment of strabismus (crossed eyes) and blepharospasm (uncontrollable blinking). This marked the first official recognition of Botox as a medical treatment.

Expanding Applications

As the medical community gained more experience with Botox, its applications expanded beyond eye disorders. In the late 1990s, it was discovered that Botox could effectively reduce the appearance of facial wrinkles. This breakthrough led to the widespread use of Botox in cosmetic procedures, such as reducing frown lines and crow’s feet.

Insurance Coverage Challenges

Initially, insurance coverage for Botox treatments was limited to its approved medical uses, such as strabismus and blepharospasm. Insurance companies typically required patients to meet specific criteria, such as failed alternative treatments, before approving coverage. However, as Botox gained popularity for cosmetic purposes, insurance coverage became a contentious issue.

The Rise of Cosmetic Botox

In the early 2000s, Botox injections became increasingly popular for cosmetic purposes. Celebrities and media attention contributed to the perception that Botox was a quick and effective way to reduce wrinkles and achieve a more youthful appearance. As demand for cosmetic Botox grew, so did the number of people seeking insurance coverage for these treatments.

Insurance Coverage Restrictions

Insurance companies faced challenges in determining coverage for cosmetic Botox. While some insurers considered it a purely cosmetic procedure and excluded coverage, others recognized its potential therapeutic benefits. Insurance policies often required medical documentation, such as evidence of chronic migraines or excessive sweating, to justify coverage for cosmetic Botox.

Expanded Medical Uses

In recent years, Botox has been approved for an increasing number of medical conditions beyond its initial indications. These include chronic migraines, overactive bladder, excessive sweating, and muscle stiffness in conditions like cerebral palsy and multiple sclerosis. The expansion of approved medical uses has influenced insurance coverage policies for Botox.

Varied Insurance Coverage Policies

Insurance coverage for Botox treatments varies widely among insurers. Some companies may cover Botox injections for approved medical uses, while others exclude coverage for cosmetic purposes altogether. Policies may also differ in their requirements for pre-authorization, medical documentation, and cost-sharing arrangements.

Out-of-Pocket Expenses

For individuals seeking cosmetic Botox treatments, out-of-pocket expenses are common. Since insurance coverage for cosmetic purposes is often limited, patients are responsible for the full cost of the procedure. The cost of Botox injections can vary depending on factors such as the geographic location, the provider’s experience, and the number of treatment areas.

Continued Debate

The question of whether insurance should cover cosmetic Botox treatments remains a topic of debate. Advocates argue that certain cosmetic uses of Botox can have significant psychological and emotional benefits for individuals. They argue that insurance coverage should be extended to include these cases. However, critics contend that cosmetic Botox is a personal choice and should not be funded by insurance.

The historical context of insurance coverage for Botox reflects the evolution of its medical applications and societal perceptions. From its origins in the treatment of eye disorders to its widespread use in cosmetic procedures, Botox has faced challenges in insurance coverage. As the medical community continues to explore new therapeutic uses for Botox, the debate over insurance coverage for cosmetic purposes is likely to persist.

Case Study 1: Sarah’s Battle with Chronic Migraines

Sarah Thompson, a 35-year-old woman from Chicago, had been suffering from chronic migraines for over a decade. These severe headaches not only caused her immense pain but also affected her ability to work and enjoy life. Sarah had tried various treatments, including medications and lifestyle changes, but nothing seemed to provide long-lasting relief.

After consulting with her neurologist, Sarah learned that Botox injections could be an effective treatment option for her chronic migraines. However, she was concerned about the cost as she didn’t have insurance coverage specifically for Botox treatments.

Determined to find a solution, Sarah researched her insurance policy and discovered that her plan covered Botox injections for certain medical conditions, including chronic migraines. Excited by this revelation, she contacted her insurance provider to confirm the details and get the necessary pre-authorization.

With the support of her neurologist, Sarah’s insurance provider approved her Botox treatments. She began receiving injections every three months, as recommended by her doctor. Over time, Sarah noticed a significant reduction in the frequency and intensity of her migraines. She was finally able to regain control of her life and pursue her career without the constant fear of debilitating headaches.

Case Study 2: John’s Struggle with Excessive Sweating

John Anderson, a 42-year-old man from Los Angeles, had been dealing with hyperhidrosis, a condition characterized by excessive sweating, for as long as he could remember. This condition affected his confidence and social interactions, as he was constantly worried about visible sweat stains and unpleasant body odor.

Desperate for a solution, John explored various treatment options and discovered that Botox injections could effectively reduce excessive sweating. However, he was unsure if his insurance would cover the cost of these treatments.

After reviewing his insurance policy, John found that his plan covered Botox injections for hyperhidrosis, provided it was deemed medically necessary. He made an appointment with a dermatologist who specialized in treating hyperhidrosis to discuss his options.

The dermatologist evaluated John’s condition and confirmed that Botox injections were indeed a suitable treatment option for him. With the necessary documentation and medical evidence, John’s insurance provider approved his Botox treatments.

Following the injections, John experienced a significant reduction in his excessive sweating. He no longer felt self-conscious in social situations and was able to focus on his professional and personal life without the constant worry of sweat-related issues. The coverage provided by his insurance policy played a crucial role in enabling him to access this life-changing treatment.

Case Study 3: Lisa’s Journey to Facial Symmetry

Lisa Johnson, a 50-year-old woman from New York City, had been living with facial asymmetry due to a condition called hemifacial spasm. This neurological disorder caused involuntary muscle contractions on one side of her face, leading to an imbalanced appearance.

Lisa’s self-esteem was greatly affected by her condition, and she often felt self-conscious about her appearance. She had heard about the potential benefits of Botox injections in treating hemifacial spasm and decided to explore this option.

When Lisa contacted her insurance provider to inquire about coverage for Botox injections, she was initially informed that it was considered a cosmetic procedure and therefore not covered. However, she persisted and requested a review of her case, emphasizing the medical necessity of the treatment for her condition.

After submitting detailed medical records and a letter of support from her neurologist, Lisa’s insurance provider agreed to reconsider her case. They ultimately approved coverage for her Botox treatments, acknowledging that it was a medically necessary procedure to alleviate her hemifacial spasm.

Following her injections, Lisa experienced a significant improvement in her facial symmetry. The involuntary muscle contractions were greatly reduced, and she finally felt more confident and at ease in her own skin. The insurance coverage played a crucial role in ensuring that Lisa could access the treatment she needed to improve her quality of life.

These case studies highlight the importance of understanding insurance coverage for Botox treatments. In each instance, individuals faced various challenges, but with perseverance and a clear understanding of their insurance policies, they were able to access the necessary treatments. It is crucial for individuals considering Botox injections to thoroughly review their insurance policies, seek medical advice, and advocate for themselves to ensure they receive the coverage they deserve.

FAQs:

1. Is Botox considered a medical necessity by insurance companies?

Generally, insurance companies do not consider Botox injections to be a medical necessity. Botox is primarily used for cosmetic purposes, such as reducing the appearance of wrinkles. However, there are certain medical conditions, such as chronic migraines or excessive sweating, where Botox may be deemed medically necessary and covered by insurance.

2. How can I determine if my insurance covers Botox?

The best way to determine if your insurance covers Botox is to review your policy documents or contact your insurance provider directly. They will be able to provide you with specific information about coverage for Botox and any associated requirements, such as prior authorization or medical documentation.

3. What medical conditions might make Botox eligible for insurance coverage?

Medical conditions that may make Botox eligible for insurance coverage include chronic migraines, cervical dystonia (a condition causing neck muscle spasms), excessive sweating (hyperhidrosis), and certain eye muscle disorders. However, coverage may vary depending on the insurance provider and the specific policy.

4. What documentation is typically required for insurance coverage of Botox?

Insurance companies often require documentation from a healthcare professional to support the medical necessity of Botox treatment. This may include medical records, diagnostic test results, and a detailed treatment plan. Prior authorization from the insurance company may also be necessary.

5. Are there any age restrictions for insurance coverage of Botox?

Insurance coverage for Botox may have age restrictions. Some insurance companies may only cover Botox for individuals above a certain age, typically 18 or 21 years old. It is important to check with your insurance provider to understand any age-related coverage limitations.

6. Does insurance cover Botox for cosmetic purposes?

No, insurance companies generally do not cover Botox injections for purely cosmetic purposes. Cosmetic treatments, such as reducing wrinkles or enhancing facial appearance, are typically considered elective and not medically necessary.

7. Are there any alternative treatments that may be covered by insurance?

For certain medical conditions, there may be alternative treatments that are covered by insurance. For example, if Botox is used to treat chronic migraines, other migraine medications or therapies may be covered. It is important to discuss with your healthcare provider and insurance company to explore alternative treatment options.

8. Can I appeal a denied insurance claim for Botox?

Yes, if your insurance claim for Botox is denied, you have the right to appeal the decision. It is recommended to review your insurance company’s appeals process and gather any necessary documentation to support your case. Working with your healthcare provider to provide additional medical justification may also be beneficial.

9. Are there any out-of-pocket costs associated with Botox?

Even if Botox is covered by insurance, there may still be out-of-pocket costs involved. These can include deductibles, co-pays, or co-insurance. It is important to review your insurance policy and understand your financial responsibilities before undergoing Botox treatment.

10. Are there any insurance plans that cover Botox for cosmetic purposes?

While it is rare, some insurance plans may offer coverage for Botox injections for cosmetic purposes. These plans are typically high-end or premium policies and may require additional premiums or higher deductibles. It is important to check with your insurance provider to see if such coverage is available and what the associated costs may be.

1. Understand your insurance coverage

Before considering any medical procedure, including Botox, it is essential to understand your insurance coverage. Review your policy documents or contact your insurance provider to determine if Botox is covered. Ask specific questions about the conditions or circumstances under which Botox may be covered, such as medical necessity or certain diagnoses.

2. Consult with your healthcare provider

If you are interested in Botox treatment, consult with your healthcare provider. They can evaluate your specific situation, discuss the potential benefits and risks, and provide guidance on whether Botox is a suitable option for you. Additionally, they may have experience dealing with insurance companies and can help navigate the coverage process.

3. Obtain a pre-authorization

If your insurance policy covers Botox under certain circumstances, it is crucial to obtain a pre-authorization from your insurance company. This involves submitting documentation, such as medical records and a letter of medical necessity from your healthcare provider, to demonstrate that the treatment is medically necessary. Without pre-authorization, your insurance may deny coverage.

4. Keep detailed records

To increase the chances of insurance coverage, keep detailed records of your Botox treatment. Document the specific symptoms or conditions being treated, the dates of each treatment, and any improvements or changes you experience. These records can serve as evidence of medical necessity and may be required by your insurance company for reimbursement.

5. Follow the proper billing and coding procedures

Correct billing and coding are essential when seeking insurance coverage for Botox. Ensure that your healthcare provider uses the appropriate billing codes that align with the specific condition being treated. Incorrect coding can lead to claim denials or delays in reimbursement.

6. Appeal if your claim is denied

If your insurance company denies your claim for Botox coverage, don’t give up. Many insurance denials can be appealed successfully. Review the denial letter carefully to understand the reasons for denial and gather any additional supporting documentation that may strengthen your case. Follow the appeals process outlined by your insurance company and seek assistance from your healthcare provider if needed.

7. Explore alternative financing options

If insurance coverage for Botox is not available or limited, explore alternative financing options. Some healthcare providers offer payment plans or financing options to help make the treatment more affordable. Additionally, there may be patient assistance programs or grants available for specific medical conditions that can help offset the cost of Botox.

8. Consider alternative treatments

While Botox may be an effective treatment for certain conditions, it is not the only option. Explore alternative treatments that may be covered by insurance or have lower out-of-pocket costs. Discuss these options with your healthcare provider to determine the best course of action for your specific situation.

9. Review your insurance policy annually

Insurance coverage can change over time, so it is essential to review your policy annually. Pay attention to any updates or changes in coverage related to Botox or other medical procedures. If you notice any discrepancies or have questions, contact your insurance provider for clarification.

10. Advocate for broader insurance coverage

If you believe that insurance coverage for Botox should be expanded to include more conditions or circumstances, consider advocating for change. Contact your insurance company, local representatives, or patient advocacy groups to voice your opinion and share your experiences. By raising awareness and advocating for broader coverage, you may contribute to positive changes in insurance policies.

Remember, the tips provided are general guidelines, and individual insurance policies and coverage may vary. It is important to consult with your healthcare provider and insurance company directly for personalized advice and information specific to your situation.

Concept 1: What is Botox?

Botox is a drug made from a toxin produced by a bacteria called Clostridium botulinum. This toxin can cause a condition called botulism, which affects the nerves and muscles. However, when used in very small amounts and administered by a trained medical professional, Botox can be used for cosmetic purposes to reduce the appearance of wrinkles and fine lines on the face.

Concept 2: How does Botox work?

Botox works by temporarily paralyzing or relaxing the muscles that cause wrinkles. When injected into specific areas of the face, it blocks the signals between the nerves and the muscles, preventing the muscles from contracting. This results in a smoother and more youthful appearance, as the wrinkles and lines become less noticeable.

Concept 3: Is Botox covered by insurance?

Insurance coverage for Botox treatments can vary depending on the specific circumstances. In general, Botox is not covered by insurance when used for cosmetic purposes, as it is considered an elective procedure. Insurance companies typically only cover treatments that are medically necessary, such as those for certain medical conditions or chronic migraines.

However, there are some situations where insurance may provide coverage for Botox. One example is when Botox is used to treat certain medical conditions, such as cervical dystonia (a condition that causes neck muscle spasms) or hyperhidrosis (excessive sweating). In these cases, insurance may cover the cost of Botox injections as part of the treatment plan.

It’s important to note that even if insurance covers Botox for medical purposes, there may still be limitations or restrictions. For example, insurance may require prior authorization, meaning that the treatment must be approved in advance. Insurance may also have specific criteria or guidelines that must be met for coverage to be provided.

In summary, Botox is a drug made from a toxin that can temporarily reduce the appearance of wrinkles. It works by relaxing the muscles that cause wrinkles, resulting in a smoother look. While insurance typically does not cover Botox for cosmetic purposes, it may provide coverage for certain medical conditions. However, coverage is subject to specific criteria and limitations set by the insurance company.

In conclusion, the question of whether Botox is covered by insurance is a complex one. While Botox is primarily known for its cosmetic uses, it also has several medical applications that can be deemed medically necessary. Some insurance companies do provide coverage for Botox injections, but the criteria for coverage vary widely. Generally, insurance companies require that Botox be used to treat specific medical conditions, such as chronic migraines or excessive sweating, and that other treatments have been tried and failed.

However, it is important to note that even if Botox is covered by insurance, there may still be limitations and restrictions. Some insurance plans may require pre-authorization, limit the number of injections, or impose high out-of-pocket costs. It is crucial for individuals considering Botox treatment to thoroughly review their insurance policy and consult with their healthcare provider to understand the coverage and potential financial implications.

Overall, while Botox can provide significant medical benefits for certain conditions, its coverage by insurance is not guaranteed. It is advisable for individuals to carefully consider the medical necessity, explore alternative treatments, and consult with their insurance provider to determine coverage and potential costs.